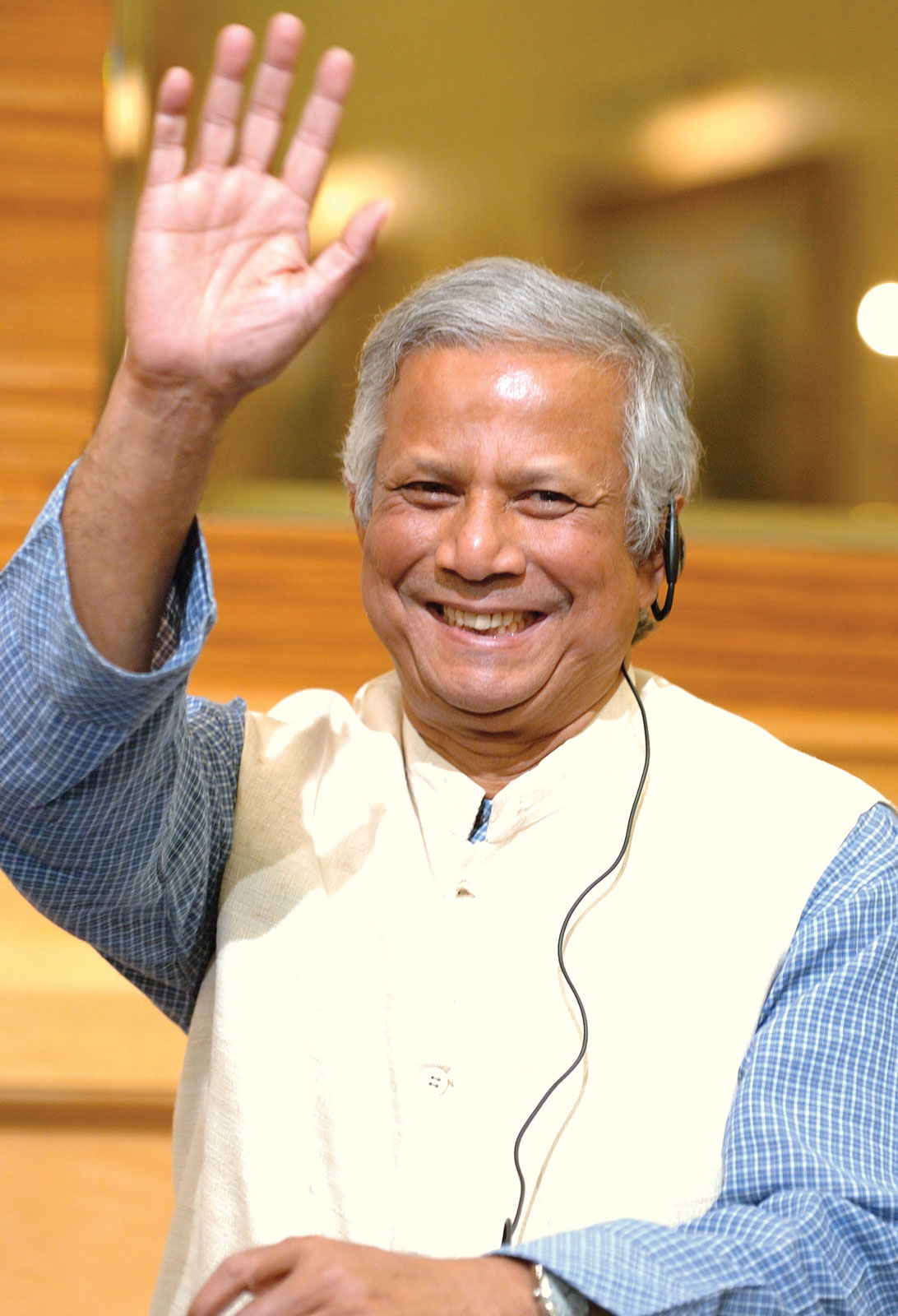

Who was this influential figure in development economics, and why is their work so impactful?

This individual championed microfinance, a system of providing small loans to impoverished individuals, particularly women, often lacking access to traditional banking. The approach is grounded in the belief that empowering people with financial resources fosters economic independence and strengthens communities. Examples include microloans for starting small businesses, purchasing tools, or covering daily needs.

The individual's work has had significant positive consequences, demonstrably reducing poverty in many developing nations. By enabling individuals to create their own ventures and livelihoods, this strategy fosters economic growth, reduces dependency on aid, and empowers women. The impact on communities is substantial, creating a ripple effect that enhances well-being and increases opportunities. This approach has garnered global attention and has influenced subsequent economic development strategies. Historically, this figure played a critical role in the transition from viewing poverty as an insurmountable problem to acknowledging the potential of individuals to improve their circumstances.

| Detail | Information |

|---|---|

| Full Name | Muhammad Yunus |

| Profession | Economist, Banker, Social Entrepreneur |

| Known for | Microcredit, Grameen Bank |

| Awards | Nobel Peace Prize (2006) |

Further exploration of this figure's work can delve into the specific programs and initiatives undertaken through organizations like Grameen Bank. This would further highlight the practical implementation of microfinance and its impact on communities worldwide.

Mohamed Yunus

Mohamed Yunus's contributions to development economics are substantial, fundamentally changing perspectives on poverty alleviation.

- Microfinance

- Grameen Bank

- Nobel Prize

- Poverty reduction

- Economic empowerment

- Small loans

- Community development

- Social entrepreneurship

Yunus's pioneering work in microfinance, epitomized by Grameen Bank, dramatically impacted impoverished communities. The Nobel Prize recognition underscored the profound effects of providing small loans, enabling individuals to start businesses and escape poverty. This, in turn, fostered community development and economic empowerment. His approach, grounded in social entrepreneurship, demonstrated how financial inclusion can lead to significant poverty reduction. The model has inspired numerous similar initiatives globally.

1. Microfinance

Mohamed Yunus's profound influence on economic development is inextricably linked to microfinance. His pioneering work established microfinance as a viable strategy for poverty alleviation and empowerment in developing economies. This approach, focusing on small loans to individuals, particularly women, challenged conventional banking models and fostered a new paradigm in addressing poverty.

- Small Loans, Big Impact

Microfinance emphasizes providing small loans, often in the hundreds or thousands of dollars, to individuals who lack access to traditional banking services. These loans frequently support entrepreneurial ventures, enabling recipients to establish or expand small businesses, purchase vital tools, or meet immediate needs. Real-world examples demonstrate how these microloans can transform livelihoods, enabling individuals to generate income, improve their standard of living, and contribute to the economic growth of their communities. This aspect of microfinance is deeply connected to Yunus's advocacy for financial inclusion and empowerment.

- Empowerment of Marginalized Groups

A significant element of microfinance is its focus on empowering marginalized groups, especially women. Traditional financial systems often exclude women due to social and cultural norms. Microfinance initiatives acknowledge and address these barriers, providing opportunities for women to become economically self-sufficient, contributing to the empowerment of women and their households. This focus on inclusion is central to Yunus's philosophy and the success of microfinance in many contexts.

- Community Development and Sustainability

Microfinance initiatives frequently emphasize building community support systems. This collaborative approach extends beyond financial transactions to include training programs, mentorship, and networking opportunities to enhance the sustainability of businesses and livelihoods. This creates a network of support, promoting the long-term economic health of the community and reducing dependence on external aid. Yunus's model recognizes the crucial role of community engagement in sustaining positive change.

- Challenging Conventional Banking Structures

Microfinance fundamentally challenged traditional banking models by recognizing the viability and potential of individuals often excluded from formal financial systems. This approach recognizes that individuals can be successful entrepreneurs and contributors to economic growth, even without traditional collateral. By circumventing the limitations of traditional banking, microfinance created pathways to economic advancement for marginalized groups. This innovative approach was integral to Yunus's vision of economic development.

In conclusion, microfinance, profoundly shaped by Yunus's leadership and vision, embodies a transformative approach to development economics. By prioritizing small loans, empowering marginalized groups, and fostering community development, microfinance offers a powerful mechanism for poverty reduction and sustainable economic growth. The model continues to evolve and adapt globally, demonstrating the lasting impact of Yunus's pioneering work.

2. Grameen Bank

Grameen Bank, a pioneering financial institution, is deeply intertwined with the work of Mohamed Yunus. Established by Yunus, the bank embodies his vision for microfinance, showcasing its practical application and global impact. Understanding Grameen Bank provides essential insight into the core tenets and outcomes of Yunus's approach to economic development.

- Foundational Role in Microfinance

Grameen Bank served as a crucial incubator for microfinance principles. Its initial success demonstrated the viability of providing small loans to impoverished individuals, particularly women, who often lack access to traditional financial services. This model, which Yunus championed, proved that small loans can significantly improve livelihoods and foster economic independence. Grameen Bank's model directly challenged conventional economic wisdom regarding the financial capacity of marginalized populations.

- Practical Application of Microcredit Principles

Grameen Bank implemented microcredit on a massive scale, offering small loans for diverse purposes, from starting small businesses to meeting daily needs. Its programs often included vital educational and support components, helping individuals manage their finances effectively. Real-world examples showcased how this approach transformed lives and fostered community development.

- Global Impact and Replication Model

Grameen Bank's success spurred the proliferation of microfinance institutions worldwide. Its model, emphasizing the importance of community involvement and empowerment, became a blueprint for similar initiatives, demonstrating the widespread applicability and global impact of Yunus's vision. The bank's experience became a case study and influenced subsequent economic development programs.

- Emphasis on Women's Empowerment

Grameen Bank actively focused on providing financial opportunities for women, recognizing their pivotal role in community development. This commitment reflected Yunus's belief in empowering marginalized groups and acknowledging the critical contributions women can make. The bank's specific initiatives for women underscored this aspect of his broader philosophy.

Grameen Bank, therefore, transcends its status as a financial institution. It represents the embodiment of Mohamed Yunus's commitment to poverty alleviation, demonstrating the power of microfinance to transform lives and communities. The bank's continued operations and global influence highlight the lasting legacy of Yunus's pioneering work in development economics.

3. Nobel Prize

The Nobel Prize in Peace, awarded to Mohamed Yunus in 2006, stands as a significant recognition of his profound contributions to development economics, particularly his pioneering work in microcredit and its associated programs. The award highlights the global impact of his initiatives and underscores the transformative potential of his strategies for poverty alleviation.

- Recognition of Microfinance's Impact

The prize acknowledged the demonstrable success of microfinance in empowering impoverished individuals, particularly women, in developing countries. Examples illustrate how small loans, coupled with essential support structures, enable entrepreneurship and sustainable economic growth within communities. The award served as a validation of Yunus's theory that financial inclusion is a key driver for poverty reduction.

- Global Validation of Yunus's Approach

The Nobel Prize provided international recognition and legitimacy to Yunus's microfinance model. This, in turn, facilitated the replication and adoption of the Grameen Bank model across various countries. The prize acted as a catalyst for broader adoption of similar initiatives, spurring the development of numerous microfinance organizations worldwide, which had a profound impact on many lives.

- Emphasis on Empowerment of Marginalized Groups

The award specifically highlighted Yunus's commitment to empowering women and other marginalized groups. The Nobel committee recognized the crucial role of financial inclusion in promoting self-sufficiency and economic independence, particularly for individuals often excluded from traditional banking systems. The award serves as a powerful testament to the transformative potential of economic empowerment for previously disadvantaged groups.

- Inspiring Further Development Initiatives

The Nobel Prize recognition provided significant inspiration for social entrepreneurship globally. It demonstrated the potential for innovative solutions to complex challenges in development economics, including poverty eradication. The award's impact extended beyond the immediate recognition, encouraging individuals and organizations to pursue similar ventures aimed at community development and empowerment.

The Nobel Prize in Peace awarded to Mohamed Yunus underscores his pioneering work in microfinance and its profound global impact. The award serves as a powerful endorsement of his vision and the transformative potential of financial inclusion to address global poverty and empower communities. It highlights the remarkable potential of individuals to initiate systemic change and build sustainable strategies for poverty reduction through innovative approaches to economic development.

4. Poverty reduction

Mohamed Yunus's work is fundamentally connected to poverty reduction. His pioneering initiatives in microfinance, exemplified by Grameen Bank, directly address the root causes of poverty by empowering individuals. This approach contrasts with traditional development models, often focused on large-scale interventions. Yunus's focus on enabling individuals to generate their own income, rather than simply receiving aid, underscores a crucial element of sustainable poverty reduction. By providing small loans to impoverished individuals, especially women, Yunus empowered them to start or expand businesses, fostering economic independence and reducing dependence on external support. This approach has been demonstrated to significantly impact communities and reduce poverty rates in various contexts globally.

The practical significance of this connection lies in its demonstrable effectiveness. Numerous case studies illustrate how microfinance initiatives, inspired by Yunus's model, have led to tangible improvements in the lives of individuals and families living in poverty. Increased income levels, improved health outcomes, and enhanced educational opportunities are often observed as a direct result of this approach. The focus on empowering individuals through financial inclusion and entrepreneurship fosters sustainable economic growth and promotes self-reliance within impoverished communities. Furthermore, Yunus's model emphasizes the critical role of women in poverty reduction, recognizing their often-underestimated potential and agency in their communities.

In conclusion, the connection between poverty reduction and Mohamed Yunus's work is multifaceted and profound. By championing microfinance and empowering individuals, Yunus's initiatives offer a practical and sustainable approach to tackling poverty. The effectiveness of this model, as demonstrated by numerous successful programs worldwide, emphasizes the importance of individual empowerment and financial inclusion as central components of any effective poverty reduction strategy. While challenges remain, Yunus's legacy underscores a pathway toward a more equitable and prosperous future for communities grappling with poverty.

5. Economic Empowerment

Mohamed Yunus's work profoundly connects with the concept of economic empowerment. His approach to microfinance, particularly through institutions like Grameen Bank, prioritizes enabling individuals, especially those marginalized in traditional economic systems, to gain control over their financial futures. This empowerment transcends mere financial transactions; it fosters self-reliance, strengthens communities, and contributes to sustainable development. This exploration delves into the critical facets of this empowerment.

- Financial Independence and Agency

Economic empowerment, as articulated by Yunus's work, hinges on individuals gaining financial independence and agency. Microloans enable entrepreneurship, allowing individuals to generate income and build assets. This empowers them to make decisions about their own lives and escape cycles of poverty, fostering self-sufficiency. Real-world examples illustrate how microloans for small businesses and other ventures can directly lead to improved livelihoods, enabling individuals to meet their basic needs and build their financial security. This agency is critical in developing economies, where traditional financial systems often exclude the most vulnerable.

- Increased Opportunities and Reduced Dependence

Empowerment, through Yunus's model, translates to increased opportunities. Access to capital allows individuals to pursue entrepreneurial ventures, creating employment and income generation. This, in turn, reduces reliance on external aid or support, promoting self-reliance and community development. The system moves away from a dependent relationship, placing individuals at the center of their economic improvement.

- Community Development and Social Impact

Economic empowerment, as facilitated by Yunus's initiatives, isn't solely about individual gains. Empowering individuals frequently leads to broader community development. Increased income translates to improvements in health, education, and overall well-being within the community. The impact encompasses the broader social fabric, contributing to sustainable development within the community.

- Challenging Systemic Barriers

Yunus's approach challenges systemic barriers that often hinder economic empowerment. Traditional banking systems often exclude marginalized groups due to lack of collateral or bureaucratic hurdles. Microfinance, as championed by Yunus, circumvents these restrictions, providing opportunities for those traditionally excluded from mainstream economic systems. This element of his approach signifies a paradigm shift in understanding financial inclusion and economic development.

In conclusion, Mohamed Yunus's work demonstrates that empowering individuals economically through microfinance has a profound impact, leading to financial independence, increased opportunities, and community development. This underscores the importance of focusing on individual agency and promoting sustainable development strategies to effectively address economic disparities.

6. Small Loans

Small loans, a cornerstone of Mohamed Yunus's philosophy and the microfinance movement, hold immense significance in combating poverty and fostering economic empowerment. This approach, distinct from traditional banking practices, focuses on providing accessible financial resources to individuals often excluded from formal credit markets, especially in developing economies. The efficacy of these small loans in catalyzing positive change is a key element of Yunus's legacy. This exploration examines the critical role of small loans in Yunus's work.

- Accessibility and Inclusivity

Small loans fundamentally address the accessibility issue within traditional financial systems. Individuals with limited or no collateral often face significant barriers to accessing credit. Yunus's model bypassed these limitations, providing financial resources to individuals previously excluded, including women, who are often underrepresented in formal banking. This inclusivity is crucial to fostering economic opportunity for marginalized groups. Examples include lending to women for small businesses, facilitating economic mobility and independence.

- Empowering Entrepreneurship

Small loans serve as vital capital for entrepreneurship. Individuals, particularly those in poverty, can use these loans to establish small businesses, improve existing enterprises, or make essential purchases, thereby generating income and improving living standards. The empowerment aspect extends beyond immediate financial gain, promoting self-reliance and fostering a sense of agency within communities.

- Sustainability and Community Impact

The impact of small loans extends beyond individual beneficiaries. By fostering entrepreneurship and local businesses, these initiatives contribute to community economic development. Increased local employment opportunities, improved infrastructure, and enhanced living standards demonstrably impact the well-being of entire communities. This community-focused approach is characteristic of Yunus's commitment to sustainable development.

- Practical Application and Measurable Impact

The effectiveness of small loans in poverty reduction is demonstrably supported by numerous case studies. Successful microfinance programs, many modeled on Yunus's initiatives, have yielded quantifiable improvements in the lives of individuals and families, highlighting the practical application of this approach to economic development. The measurable impact underscores the value and efficacy of small loans in achieving tangible outcomes.

In summary, small loans are central to Mohamed Yunus's philosophy. Their accessibility, role in empowering entrepreneurs, contributions to community development, and measurable impact collectively underscore the transformative potential of microfinance. These insights highlight the enduring value of small loans in creating sustainable and equitable economic opportunities for individuals and communities, particularly those traditionally excluded from mainstream financial systems.

7. Community Development

Mohamed Yunus's work is deeply intertwined with community development. His emphasis on microfinance, particularly through institutions like Grameen Bank, profoundly impacts communities by fostering economic empowerment and social upliftment. The focus on small loans, entrepreneurship, and community support systems directly contributes to the overall well-being and sustainability of communities, particularly in developing nations.

- Economic Empowerment and Self-Reliance

Yunus's approach to development prioritizes economic self-reliance within communities. Small loans empower individuals to establish businesses, generate income, and improve their livelihoods. This, in turn, reduces reliance on external aid and fosters sustainable economic growth. Examples demonstrate how this approach, often centered on women, creates a positive ripple effect, benefiting entire families and contributing to a more robust local economy.

- Strengthened Social Networks

Microfinance initiatives often incorporate community support systems. These networks facilitate knowledge sharing, mentorship, and collective problem-solving. By promoting cooperation and collaboration within communities, these networks strengthen social bonds, enhance social capital, and contribute to a more cohesive community structure. This aspect emphasizes the interconnectedness of individuals and the collective potential for advancement.

- Improved Infrastructure and Services

The economic growth spurred by microfinance frequently leads to improvements in community infrastructure and access to essential services. Increased income often results in investment in local infrastructure, healthcare, education, and other services. This iterative process underscores how economic empowerment translates into tangible improvements in the quality of life within communities. This underscores the interconnectedness of economic and social progress.

- Increased Civic Engagement and Participation

As individuals experience economic empowerment and improved living conditions, their engagement with community issues tends to increase. This heightened sense of responsibility and agency contributes to a more active and participatory citizenry. Individuals are more involved in local initiatives, governance, and decision-making processes. This demonstrates the potential of economic empowerment to strengthen democratic participation and local governance structures within communities.

In essence, Mohamed Yunus's approach to development, particularly through microfinance, is fundamentally about building resilient and empowered communities. The interconnectedness of economic empowerment, social networks, infrastructure development, and civic engagement underscores the profound positive impact of his initiatives on the long-term sustainability and well-being of communities globally.

8. Social Entrepreneurship

Mohamed Yunus's work is inextricably linked to social entrepreneurship. His pioneering efforts in microfinance, exemplified by Grameen Bank, embody the core principles of this approach. Social entrepreneurship, fundamentally, involves using entrepreneurial principles to address societal problems. Yunus applied this approach by recognizing the potential of impoverished individuals, particularly women, to be agents of their own economic advancement. Instead of viewing poverty as an insurmountable issue, he treated it as a problem solvable through individual empowerment and access to financial resources.

Yunus's model exemplifies several key aspects of social entrepreneurship. Firstly, it demonstrates a focus on finding innovative solutions to pressing social issues. Microfinance, by bypassing conventional banking barriers, offered a novel approach to empowering the impoverished. Secondly, it emphasizes a strong social mission. Grameen Bank's explicit goal was to uplift communities through economic independence, not just profit. Thirdly, it underscores a commitment to measurable impact. The success of Grameen Bank in reducing poverty across numerous communities demonstrates the practical effectiveness of Yunus's approach and serves as a compelling example for other social entrepreneurs. For instance, Grameen Bank's focus on providing microloans for businesses, often run by women, exemplifies how entrepreneurial ventures can drive positive change and economic independence within marginalized communities. The model demonstrates a direct cause-and-effect relationship between social entrepreneurship and measurable positive community impact.

In conclusion, Mohamed Yunus's work stands as a powerful testament to the transformative potential of social entrepreneurship. By applying entrepreneurial principles to solve pressing social problems, Yunus and his associated institutions created a model that has inspired numerous similar initiatives worldwide. His efforts highlight the importance of recognizing the agency of individuals, particularly within marginalized communities, and creating opportunities for economic empowerment to directly address social issues. While challenges in implementation and scalability persist, Yunus's example underscores the vital role social entrepreneurship plays in sustainable development and reducing global poverty.

Frequently Asked Questions about Mohamed Yunus

This section addresses common inquiries regarding the life and work of Mohamed Yunus, a renowned economist and social entrepreneur. The questions aim to clarify key aspects of his contributions to microfinance and development economics.

Question 1: What is microfinance, and how did Mohamed Yunus contribute to its development?

Microfinance is a system of providing small loans and other financial services to individuals and groups, typically in developing countries, who are often excluded from traditional financial institutions. Mohamed Yunus was a pioneering figure in this field. He established Grameen Bank, a model for microfinance institutions, which provided small loans to impoverished individuals, particularly women, to start and sustain businesses. Yunus's work demonstrated the viability of providing financial services to marginalized groups and empowered them to improve their economic circumstances.

Question 2: How did Grameen Bank exemplify Yunus's philosophy?

Grameen Bank, established by Yunus, operated on the principle of empowering individuals through financial inclusion. The institution recognized the potential for economic improvement in even the most disadvantaged communities. It extended credit to those lacking collateral, offering small loans for various purposes and providing crucial support structures like training and mentorship. This approach directly challenged conventional banking models and underscored Yunus's commitment to improving the lives of the poor.

Question 3: What was the significance of Yunus's work being recognized with the Nobel Peace Prize?

The Nobel Peace Prize awarded to Mohamed Yunus in 2006 highlighted the profound impact of his work on poverty reduction and development. The recognition validated microfinance as a viable and effective strategy for economic empowerment, inspiring similar initiatives globally. It further emphasized the importance of addressing poverty through community-based economic solutions and individual empowerment.

Question 4: What impact did Yunus's work have on women's empowerment?

A central element of Yunus's model was empowering women. Grameen Bank and similar microfinance institutions specifically targeted women due to their often-marginalized status within traditional economic systems. By providing access to credit, Yunus's work enabled women to start businesses, gain financial independence, and improve the economic well-being of their families and communities.

Question 5: Is microfinance a perfect solution for poverty? What are some of the challenges?

While microfinance, as championed by Yunus, has demonstrably improved lives and reduced poverty in numerous contexts, it is not a universal solution. Challenges exist in terms of loan repayment, financial literacy, and sustainable business development. Furthermore, cultural and social norms can present obstacles. Microfinance needs to be considered a tool within a comprehensive strategy for addressing the multifaceted dimensions of poverty.

In conclusion, Mohamed Yunus's work stands as a powerful example of how economic empowerment can lead to significant positive change in individuals and communities. His legacy extends beyond microfinance, inspiring a broader understanding of development economics and social entrepreneurship.

Moving forward, a detailed exploration of specific case studies showcasing the impact of microfinance initiatives would further illuminate the complexities and nuances of Yunus's work.

Conclusion

Mohamed Yunus's life and work represent a profound contribution to development economics and social entrepreneurship. His pioneering approach to microfinance, epitomized by Grameen Bank, challenged conventional development models by focusing on empowering individuals, particularly women, in impoverished communities. The model's emphasis on small loans, community support systems, and entrepreneurship fostered significant economic growth and reduced poverty in numerous contexts globally. The demonstrable success of this approach, often surpassing traditional banking models, underscored the potential for individual empowerment as a driving force for sustainable development. Yunus's work highlighted the importance of financial inclusion and recognized the agency of individuals previously marginalized in traditional economic systems.

The legacy of Mohamed Yunus extends beyond the realm of microfinance. His work inspired numerous initiatives and organizations devoted to poverty alleviation and economic development worldwide. While challenges remain in scaling and sustaining these programs, the enduring impact of his model underscores the importance of community-centered, individual-focused strategies for fostering long-term economic growth. Future efforts in global development must continue to consider and adapt the innovative principles and methodologies championed by Yunus, acknowledging the crucial role of individual agency and financial inclusion in building more equitable and prosperous societies.

Jackie Stallone Net Worth 2024: A Deep Dive

Dugg Sentence 42: Mind-Blowing Quotes

Is CeCe Winans Sick? Recent Health Updates