Comparing Two Investment Options: A Crucial Decision for Portfolio Construction

This analysis explores the differences between two prominent investment vehicles, highlighting their unique characteristics and potential applications within a diversified portfolio. A crucial decision for investors involves understanding the nuances of each. This comparison emphasizes the importance of tailored investment strategies based on individual risk tolerance and financial goals.

These two investment options likely represent different approaches to asset allocation. One might emphasize growth potential while the other prioritizes stability and income. Each carries a varying degree of risk. The specific investments or funds represented by "qqq" and "vti" are likely to differ in their constituent holdings, diversification strategies, and investment philosophies. A thorough understanding of the underlying investments is essential for informed decision-making. Recognizing the unique characteristics of each is critical to constructing an effective portfolio. Investment choices should always align with individual financial objectives.

Understanding the intricacies of these different investment structures is crucial. For instance, one may focus on a specific sector or market segment, potentially impacting diversification and overall risk. A deep dive into the fundamental differences will allow investors to make well-informed choices aligned with their financial goals. The long-term implications of such choices are significant, and thorough research and analysis are imperative.

qqq vs vti

Comparing investment options "qqq" and "vti" necessitates a thorough analysis of their distinct characteristics. Understanding these fundamental distinctions is crucial for informed financial decisions.

- Asset Allocation

- Expense Ratio

- Sector Focus

- Risk Tolerance

- Diversification

- Long-Term Growth

Analyzing "qqq" and "vti" requires examining their core components. "qqq," likely a sector-specific fund, offers potentially higher growth but also carries greater risk. Conversely, "vti," a broad market index fund, provides more balanced exposure and lower risk. Expense ratios, though seemingly minor, can significantly affect long-term returns. Understanding sector focus is crucial; a concentrated strategy in "qqq" might yield higher rewards but also greater volatility. Risk tolerance, an investor's capacity for loss, plays a critical role. "Vti," with its diversified holdings, often aligns with lower risk tolerance. Diversification is key; both options can be incorporated into a portfolio to reduce risk. Long-term growth potential is an overarching consideration. A strategic approach, considering individual circumstances, is paramount in maximizing returns while managing risk effectively.

1. Asset Allocation

Asset allocation, a core component of investment strategy, is paramount when considering options like "qqq" and "vti." The strategic distribution of investments across various asset classes directly influences potential returns and risk exposure. Choosing between "qqq" and "vti" fundamentally involves understanding how each fits into a well-defined asset allocation plan. This analysis explores key aspects of asset allocation in the context of these specific investment choices.

- Defining Portfolio Composition

Asset allocation dictates the proportion of investments in different asset classes. A portfolio heavily weighted towards "qqq," a potentially high-growth option, contrasts sharply with one favoring "vti," which often represents a more balanced, lower-risk approach. The ideal allocation depends on individual risk tolerance and financial objectives. The strategic interplay between these choices directly impacts the overall portfolio risk profile. Choosing the right mix hinges on understanding the specific investment strategies of the products.

- Risk Tolerance and Objectives

An investor's risk tolerance and financial goals are fundamental to effective asset allocation. A young investor with a long investment horizon might tolerate higher risk and thus favor a higher allocation towards growth-oriented assets like those potentially represented by "qqq." Conversely, an investor nearing retirement may prioritize capital preservation and opt for a lower-risk allocation, potentially emphasizing "vti." This understanding is key to achieving optimal portfolio returns while aligning with individual needs.

- Diversification Benefits

Effective asset allocation incorporates diversification. Including both "qqq" and "vti" in a portfolio, for instance, can diversify risk. This mitigates the impact of any single investment's poor performance. The diversification strategy chosen needs to reflect the investor's understanding of potential market trends and overall investment objectives.

- Market Influences and Rebalancing

Market fluctuations necessitate periodic rebalancing of asset allocations. Significant market shifts can impact the balance between various investments. Appropriate rebalancing ensures the portfolio consistently aligns with the investor's risk tolerance and long-term goals. This process is crucial for maintaining the desired risk-reward profile, especially when choosing between potentially disparate asset allocations that may reflect different investment styles.

In summary, asset allocation is not merely a technical exercise; it's a strategic process that directly influences the success of investment choices like "qqq" and "vti." Carefully considering individual risk tolerance, financial objectives, and diversification strategies are key components to developing a tailored asset allocation plan. This process allows investors to make informed decisions when evaluating choices like "qqq" and "vti" within the context of a broader financial strategy.

2. Expense Ratio

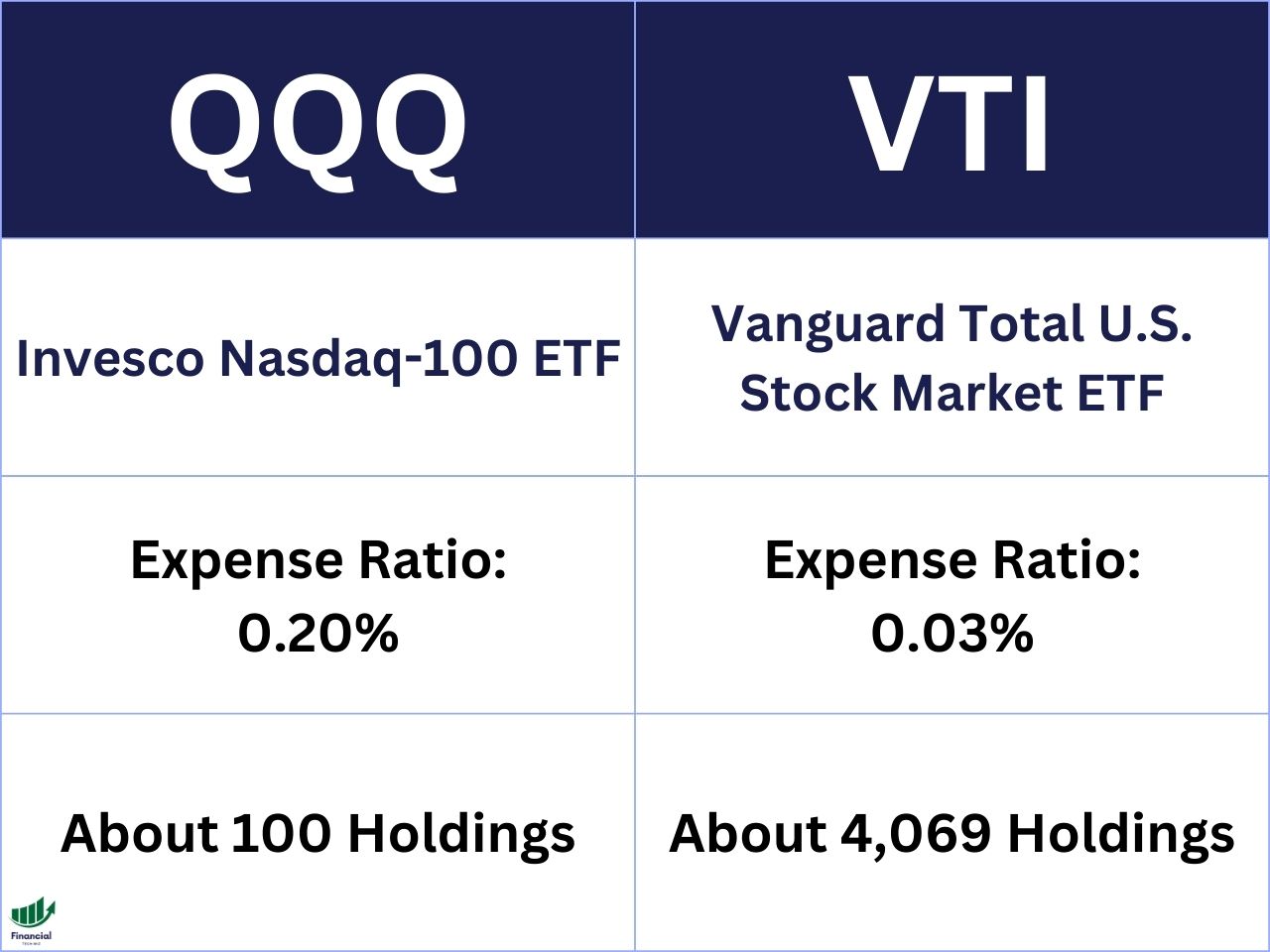

Expense ratios are critical considerations when comparing investment options like "qqq" and "vti." These seemingly small fees accumulate over time, significantly impacting overall returns. Understanding the expense ratio's role in the performance of these funds is vital for informed investment decisions.

- Impact on Returns

Expense ratios represent the annual fees charged for managing the investment. A higher ratio directly reduces the net return achievable by an investor. This reduction compounds over time, resulting in a substantial difference in long-term gains between funds with varying expense ratios. Comparing "qqq" and "vti" requires analyzing these costs to see how they affect potential returns.

- Comparison and Selection

Investors should meticulously compare expense ratios when evaluating "qqq" and "vti." A lower expense ratio translates into greater returns. Choosing between funds with a significant difference in expense ratios might affect the investor's overall profitability. Factors like investment strategy, fund size, and the level of active management can impact this figure.

- Long-Term Implications

Expense ratios, while seemingly minor, accumulate over extended periods. This compounding effect on returns is substantial and should not be underestimated. An apparently small difference in expense ratios can lead to a considerable disparity in long-term investment value. This factor plays a crucial role in the long-term investment analysis of "qqq" versus "vti." Careful scrutiny of these fees is paramount when constructing a portfolio.

- Fund Structure and Management Style

The structure and management style of a fund can impact its expense ratio. Passive index funds, often characterized by a lower expense ratio, are usually managed less actively compared to actively managed funds. Understanding this difference is critical when considering expense ratios. Factors such as fund size, trading frequency, and administrative costs are key to interpreting the expense ratio within the context of "qqq" versus "vti."

In conclusion, while seemingly a minor detail, the expense ratio plays a significant role in the overall performance and returns of funds like "qqq" and "vti." Carefully analyzing and comparing these ratios is crucial for making well-informed investment decisions. The long-term implications of seemingly small differences in expense ratios should be factored into the selection process, and understanding the different management styles and associated costs is paramount for optimizing investment portfolios.

3. Sector Focus

Understanding sector focus is crucial when comparing investment options like "qqq" and "vti." The specific industries a fund emphasizes significantly impacts its risk and return characteristics. This analysis examines the implications of sector focus on the contrasting investment strategies represented by "qqq" and "vti." The different sectors targeted by each fund directly influence potential investment performance and overall portfolio risk.

- Differing Industry Exposures

Fund "qqq" likely emphasizes a specific sector, perhaps technology, whereas "vti" aims for a broad market representation, encompassing various sectors. This fundamental difference in sector focus leads to distinct risk profiles. Funds like "qqq" concentrate their investments within a single industry, potentially experiencing amplified returns if the sector performs well but also higher volatility if the sector falters. Conversely, funds like "vti" aim for balanced exposure to multiple sectors, providing potentially more stable returns but lower potential for dramatic growth in specific sectors.

- Risk Diversification Considerations

The diverse composition of "vti" significantly contributes to portfolio diversification. By encompassing numerous sectors, its investments are less susceptible to the volatility of individual sectors. "Qqq," however, carries a higher level of sector-specific risk. Investors must carefully consider this when constructing a diversified portfolio that accounts for various levels of risk.

- Investment Strategy Alignment

The investment strategy embedded within "qqq" likely reflects a focused approach to a particular sector, potentially leveraging insights into industry trends and advancements. A broad-based fund like "vti" employs a different strategy, focusing on overall market performance and broader economic factors. This disparity in investment strategy profoundly impacts the potential returns and risk profiles of each fund.

- Performance Correlation to Sector Trends

Performance of funds like "qqq" is directly linked to the performance of its designated sector. Significant economic shifts or changes within that sector can substantially influence its returns. In contrast, performance of a fund like "vti" is affected by a broader range of factors, including economic trends, interest rate changes, and investor sentiment across various sectors.

In conclusion, the sector focus of investments like "qqq" and "vti" is a critical factor in portfolio construction. "Qqq," with its concentrated sector approach, potentially offers higher growth potential but comes with increased risk. "Vti," on the other hand, provides broader diversification, potentially mitigating risk but potentially limiting maximum growth. Investors must carefully align their investment choices with their risk tolerance, long-term goals, and specific sector outlook for optimal portfolio returns.

4. Risk Tolerance

Risk tolerance is a crucial factor in investment decisions, particularly when evaluating options like "qqq" and "vti." Individual financial objectives and comfort levels with potential losses significantly influence the suitability of these investments. This analysis explores the connection between risk tolerance and the selection between "qqq" and "vti," highlighting the importance of aligning investment choices with personal circumstances.

- Impact on Investment Choice

Different investment profiles necessitate varying degrees of risk tolerance. An investor with a high risk tolerance might be comfortable with the potential for greater returns but also increased volatility, potentially favoring "qqq," a more concentrated investment. Conversely, an investor with a lower risk tolerance might prioritize capital preservation and seek stability, potentially leaning towards "vti," an investment offering broader diversification and lower volatility. The optimal choice aligns the investment strategy with the individual's capacity for potential loss.

- Investment Horizon and Objectives

Investment horizon plays a significant role. A longer investment horizon, such as that of a younger investor, may allow for greater risk-taking as the potential for recovery from market downturns increases. Conversely, those nearing retirement may need a more conservative approach to protect accumulated capital. Matching the investment strategy to the investor's timeframe and goals is a key consideration. The appropriate choice depends on personal financial objectives and how long the investment will be held.

- Potential for Loss and Recovery

Recognizing the potential for loss is intrinsic to evaluating risk tolerance. An investor comfortable with temporary losses and possessing the resources to withstand market fluctuations can potentially align with "qqq's" higher-growth potential. However, an investor with limited resources may find "vti's" lower volatility more suitable. The ability to absorb potential losses directly affects the appropriateness of each investment.

- Diversification and Portfolio Impact

Diversification is a crucial aspect of risk management, particularly when comparing "qqq" and "vti." A more diversified investment like "vti" often aligns with lower risk tolerance by lessening the impact of any single sector's underperformance. The degree of diversification should be carefully considered in conjunction with risk tolerance to create an appropriate portfolio mix.

In summary, risk tolerance is fundamental when evaluating investments such as "qqq" and "vti." Aligning investment choices with an individual's risk tolerance, investment horizon, and capacity to absorb potential losses is critical. Understanding these factors enables investors to construct a portfolio that effectively balances risk and reward. A thoughtful approach, integrating financial goals and the associated levels of acceptable loss, is essential when deciding between investment options with differing risk profiles.

5. Diversification

Diversification, a cornerstone of investment strategy, assumes significant importance when evaluating investment choices like "qqq" versus "vti." The concept of diversification aims to mitigate risk by distributing investments across various asset classes, sectors, or market segments. A crucial aspect of comparing "qqq" and "vti" lies in understanding how each addresses this principle. The contrasting approaches to diversification within these funds have profound implications for portfolio risk management and overall investment performance. This analysis examines the practical application of diversification to investment strategies exemplified by these two choices.

Fund "qqq" likely represents a concentrated strategy, potentially emphasizing a specific sector or market segment. This approach, while offering the prospect of amplified returns if the chosen sector performs well, carries a heightened risk of substantial losses if that sector experiences adverse conditions. In contrast, "vti," a broad market index fund, aims for diversification across numerous sectors. This wider range of holdings serves to mitigate the impact of underperformance in any one sector. A diverse portfolio, such as one incorporating both "qqq" and "vti," attempts to balance the potential benefits of specialized investments with the reduced risk inherent in a more diversified structure. Real-world examples of market fluctuations underscore the importance of diversification. Sectors experience boom-and-bust cycles. A well-diversified portfolio can help an investor navigate these fluctuations with reduced vulnerability to significant losses.

The practical significance of understanding diversification in the context of "qqq vs vti" extends to the construction of effective investment portfolios. Investors need to assess their risk tolerance and investment objectives. This process allows a reasoned evaluation of how different levels of diversification align with individual circumstances. Investors seeking substantial growth may accept a higher degree of risk associated with a more concentrated strategy like "qqq." Conversely, those prioritizing capital preservation might favor the broader diversification offered by "vti." Ultimately, a strategic approach involves understanding the relative importance of risk tolerance, diversification, and long-term investment goals. Careful consideration of diversification is fundamental to informed investment decisions. Successful portfolio construction requires a comprehensive understanding of risk-adjusted returns and the impact of various investment strategies on potential outcomes.

6. Long-Term Growth

Long-term growth potential is a paramount consideration when evaluating investment options like "qqq" versus "vti." The ability of these funds to generate returns over extended periods directly impacts their suitability for achieving long-term financial objectives. This analysis explores the factors influencing long-term growth, focusing on how these factors differentiate "qqq" and "vti." The potential for compounding returns, a key element in long-term growth, is a critical aspect of this comparison.

- Investment Strategy and Sector Focus

The fundamental investment strategies of "qqq" and "vti" directly influence long-term growth prospects. "Qqq," often a sector-specific fund, concentrates investments in a particular market segment. This focused approach can amplify returns if the chosen sector thrives but also exposes the fund to greater volatility if the sector experiences decline. Conversely, "vti," a broad market index fund, seeks diversification across a wider spectrum of sectors. This approach can provide more stable returns but may limit the potential for exceptional growth in any one sector. The specific holdings within each fund and their strategies are crucial considerations in assessing long-term growth potential.

- Market Cycles and Economic Conditions

Market cycles and broader economic conditions exert a significant influence on long-term growth. Economic downturns can negatively impact both funds, but the varying degrees of diversification inherent in each may affect the rate of recovery. The sensitivity of "qqq" to specific sector performance during economic downturns may result in larger losses compared to "vti." The relative performance of each fund during previous market cycles can offer insights into their resilience and potential for long-term growth during future economic conditions. Thorough research into past performance is vital for assessing this aspect.

- Expense Ratios and Management Fees

Expense ratios and management fees, often seemingly minor, compound over time and significantly affect long-term growth. Funds with lower expense ratios provide a higher percentage of returns to investors. Comparing "qqq" and "vti" requires careful consideration of these fees, which can impact the accumulated returns over a long investment period. Lower costs can translate into greater overall returns and improved long-term growth potential.

- Diversification and Risk Management

Diversification and risk management strategies directly influence long-term growth potential. Diversification across multiple sectors, as exemplified by "vti," can reduce the impact of adverse economic conditions within individual sectors. This approach might lead to more stable, albeit potentially less dramatic, long-term growth. "Qqq," with its focused approach, might experience greater upswings and downswings reflecting the performance of the targeted sector. Understanding the interplay between risk and potential returns is vital for long-term growth analysis. The degree of diversification plays a crucial role in mitigating risk and maximizing returns in the long term.

Ultimately, the choice between "qqq" and "vti" concerning long-term growth hinges on the investor's risk tolerance, time horizon, and investment goals. A long-term investor willing to accept higher risk might find the potential for enhanced returns in "qqq" attractive. A more conservative investor with a longer investment timeframe might favor the stability and broader diversification offered by "vti." Comprehensive due diligence, considering factors like expense ratios, market trends, and potential sector risks, is critical to achieving long-term investment objectives.

Frequently Asked Questions

This section addresses common inquiries regarding the comparison between investment options "qqq" and "vti." These questions aim to clarify key differences and considerations for investors.

Question 1: What are the core differences between "qqq" and "vti"?

Fund "qqq" likely represents a focused approach to a particular market sector, such as technology. This strategy prioritizes potential higher returns but involves greater risk due to concentrated holdings. "Vti," in contrast, typically represents a broad market index fund, offering diversification across numerous sectors. This diversification generally leads to more stable returns but potentially lower growth compared to sector-focused investments.

Question 2: How does the expense ratio impact investment returns?

Expense ratios are annual fees charged for managing investments. Higher expense ratios directly reduce the net returns achievable by investors. These seemingly minor costs can accumulate over time, significantly impacting long-term returns. A lower expense ratio results in a greater percentage of returns for investors.

Question 3: What role does risk tolerance play in the selection process?

Risk tolerance, an investor's capacity for potential losses, is paramount. Investors with a higher risk tolerance might find a more concentrated strategy, such as "qqq," more suitable. Conversely, investors prioritizing capital preservation often prefer the diversification offered by a fund like "vti."

Question 4: How does sector focus affect overall performance?

The specific sector a fund targets directly impacts its potential performance. Funds like "qqq" are highly sensitive to sector-specific trends and can experience heightened volatility relative to a broad market fund like "vti." This difference necessitates careful consideration of market conditions and individual risk tolerance.

Question 5: What is the importance of diversification in long-term investment?

Diversification across various sectors is a key risk mitigation strategy. A broad market index fund like "vti" helps lessen the impact of a poor performance in a single sector. Understanding the degree of diversification is crucial for effective portfolio construction and managing risk.

In summary, the choice between "qqq" and "vti" demands a comprehensive understanding of individual risk tolerance, investment goals, and market conditions. A well-informed investor considers potential returns, associated risks, and expense ratios. This process of analysis allows for informed decisions aligned with personal financial objectives.

This concludes the FAQ section. The subsequent section will delve deeper into the practical application of these investment principles.

Conclusion

The comparison between "qqq" and "vti" highlights the complexities inherent in investment decisions. Critical factors, including asset allocation, expense ratios, sector focus, risk tolerance, diversification, and long-term growth potential, significantly influence the suitability of each option for various investment profiles. "Qqq," with its sector-specific focus, presents potential for higher returns but also greater volatility. "Vti," representing a diversified approach, generally offers more stability but potentially lower growth rates. The optimal choice depends on aligning investment strategy with individual circumstances, financial objectives, and risk tolerance. A crucial understanding of the inherent trade-offs between risk and reward is essential for effective portfolio construction.

Ultimately, careful consideration of individual circumstances, including financial goals, investment horizon, and risk tolerance, is paramount when selecting investment options like "qqq" and "vti." Thorough research, analysis, and professional guidance can aid investors in making informed decisions that align with long-term financial objectives. Investors should continuously monitor market conditions and rebalance their portfolios as needed to maintain alignment with evolving circumstances and long-term goals. The evaluation of market trends and their potential impacts on the chosen investment strategies is an ongoing responsibility for sustained financial success.

QQQ Vs. VTI: Fund Comparison & Winner

Is Goldbacks A Good Investment? Pros & Cons

Cliff Illig: Top Insights & Strategies